Receipt For Donation Of Goods

These include the physical Return Receipt and the electronic Return Receipt. The IRS allows you to deduct fair market value for gently-used items.

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

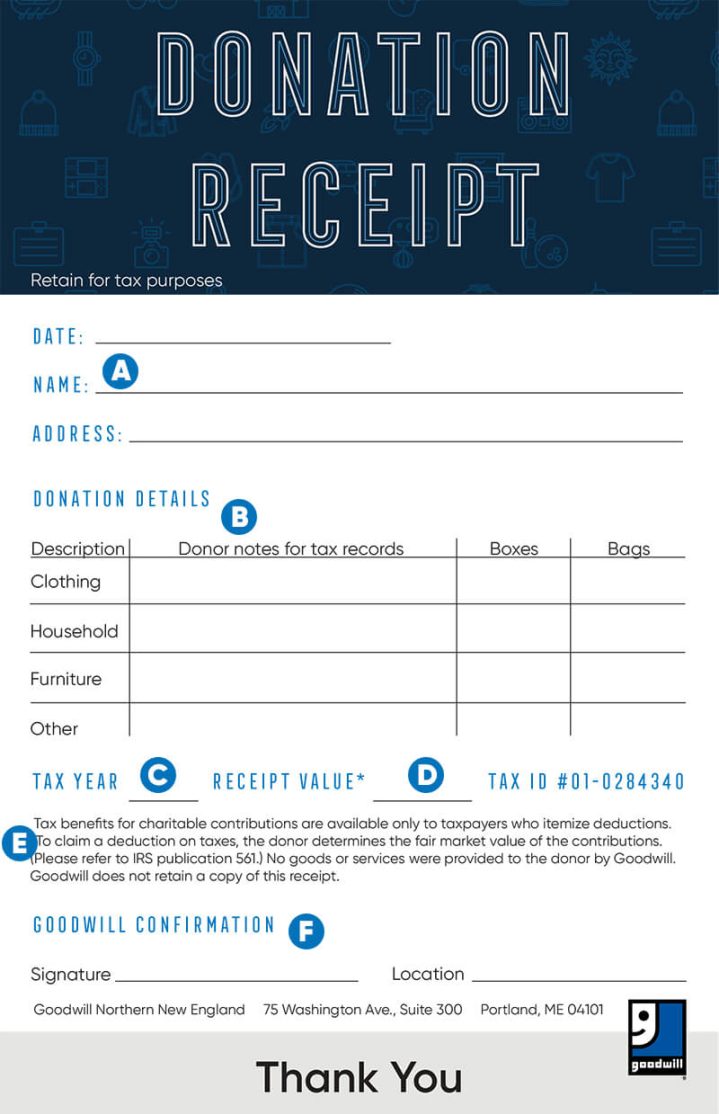

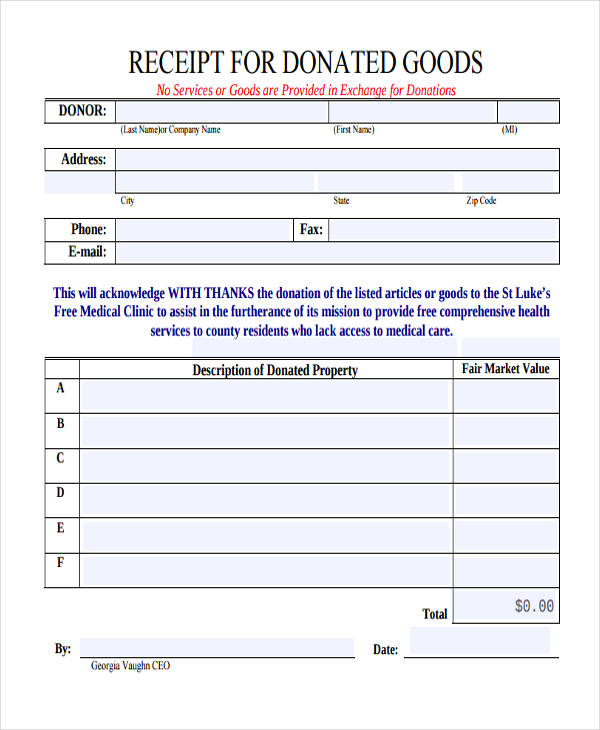

If you plan to create your own template make sure to include the following information.

. Updated June 03 2022. By providing receipts you let your donors know that their donation was received. To get your donation receipt online text RCPT to 628 345-5959 or scan the QR code as you exit You can also click the Get A Donation Receipt icon below FIND A DONATION LOCATION.

Registered nonprofit organizations can issue both official donation tax receipts and more. This type of return receipt is often delivered through the postal address or hand delivery. If you are using a tablet or mobile device you cannot enter any data.

Use this donation calculator to find calculate as well as document the value of non-cash donations. An expert will tell you that there are two types of Return Receipts. How much can you deduct for the gently used goods you donate to Goodwill.

Updated June 03 2022. Easy preparation of a financial statement. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture appliances or related items.

This is required by law. For more information on how to. Easy preparation of tax returns.

Mistakes to Avoid When Giving Donation Receipts. By law a charity. However you can browse the sheet to find values.

A donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. To receive a tax deduction the donor must obtain a receipt for their in-kind. Receipts are used for record-keeping by both the seller and the buyer.

Give a donation receipt for a donation of at least 75 which is used to buy goods or services. Receipts ease the work of making financial statements at the end of the day month or even end of a financial year. Value usually depends on the condition of the item.

Therefore the ideal way to use this spreadsheet is by laptop or desktop computer. It shows proof of a money transaction. Moreover you can only issue a donation receipt under the name of the individual who made the donation.

A physical Return Receipt is either printed or handwritten. Once a donation location has reached full capacity it can no longer accept new donations. Goodwill Central Coast information for tax return with address of your donation center.

Goodwill will be happy to provide a receipt as substantiation for your contributions in good used condition only on the date of the donation. Please do not leave donations at closed locations. You can look up clothing household goods furniture and appliances.

To prepare an accurate tax return statement. Please do not leave donations at closed locations. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status.

Also note that we are not accepting furniture donations at this time. A 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or moreIts utilized by an individual that has donated cash or payment personal property or a vehicle and. Our donation value guide displays prices ranging from good to like-new.

IRS a taxpayer can deduct the fair market value of clothing household goods used furniture shoes books and so forth. You should include this information to make your document useful and official. Always give a donation receipt if the donor or beneficiary asks for it no matter what amount was given to the organization.

For example a business may choose to donate computers to a school and declare that donation as a tax deduction. The quality of the item when new and its age must be considered. A donation receipt template should comply with particular requirements when it comes to the information it contains.

Use the online donation receipt builder to track and keep important IRS guidelines for your tax return after donating to Goodwill. The IRS requires an item to be in good condition or better to take a deduction. The recipient and the.

Fair market value is the price a willing buyer would pay for them. Benefits of Using a Receipt.

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne

Free Salvation Army Donation Receipt Word Pdf Eforms

Free Goodwill Donation Receipt Template Pdf Eforms

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Bridging Item Donation Receipt Bridging

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Free Goodwill Donation Receipt Template Pdf Eforms

Comments

Post a Comment